What employers need to know about buying and optimizing recruitment process outsourcing solutions

In today's environment, a significant number of conversations revolve around inflation, the economy, and the overall labor economics landscape. These key markers have led to a softening of the overall RPO market as employer demand for recruitment outsourcing has slowed in step with the overall reduction in hiring activity. This has driven RPO firms to consider other partnership options with employers that were less attractive in recent times, adjust pricing to be more conservative, and opening up to projects and pilots that weren’t possible in more competitive times.

In this 37-page report, you'll find 26 figures and insights on the following topics:

What RPO buyers are looking for this year

Hiring Strategy and Business Alignment

Understanding RPO offerings and pricing options

Reasons employers are changing RPO providers

The visible and underlying value of RPO relationships

In its second year, the RPO Trends Study is an annual collaboration between the Recruitment Process Outsourcing Association and Lighthouse Research and Advisory aimed at providing data-driven insights into the current value and buying considerations for RPO buyers.

Watch analyst Ben Eubanks of Lighthouse Research and Advisory speak about the 2023 RPO Trends Study at the RPOA Annual Conference in Chicago, IL, on September 25, 2023.

Existing RPO Users

Employers who are currently working with an RPO partner can use this as a guide to consider how their arrangement compares with those of other firms.

Future RPO Users

Employers considering the usage of an RPO will find helpful data points to build a business case, ideas for how to get the most from an RPO partner, and insights for ways to structure the relationship to minimize risk and increase satisfaction.

Other RPO Players

Companies offering RPO services, investors in the RPO space, and HCM analysts will find insights on RPO users valuable in their assessments or business development.

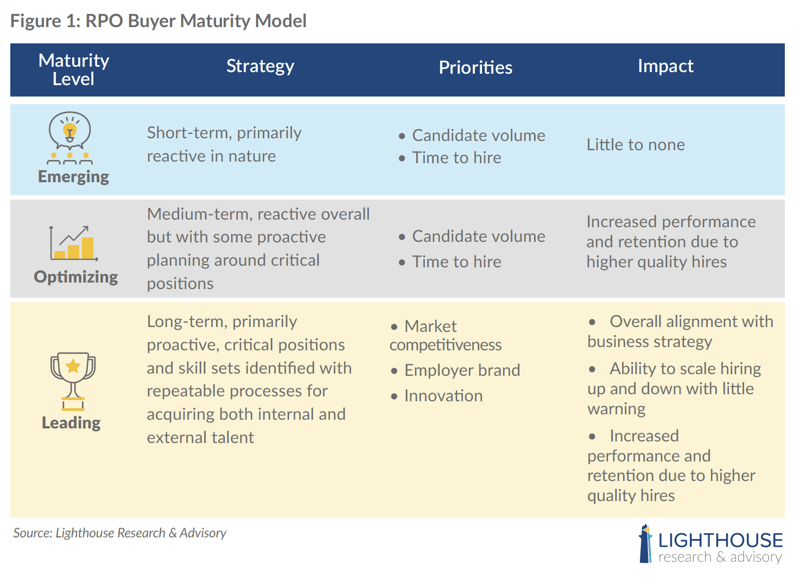

In this report, you'll be introduced to the RPO maturity model, which categorizes RPO buyers based on their experience into one of three buckets.

Wherever your organization falls on the spectrum, it’s possible to level up and increase maturity over time by focusing on the right outcomes and markers that set mature organizations apart from the rest.

As employers become more mature, they look from transactional outcomes to more strategic ones. They also begin to have longer-term horizons for planning and more nuanced understanding of their business-critical skillsets.

As a current or potential buyer of RPO services, this report is a guide designed to leverage research from 519 different organizations to understand:

The research not only highlights what is happening right now, but also provides some insight into how things have shifted over the last year, offering a helpful perspective for talent leaders who want to develop a modern, comprehensive talent strategy that incorporates the value RPO firms deliver.

You don't want to miss out on being informed and making the best decisions for your business. ACCESS YOUR FREE COPY NOW.

Disclaimer: By downloading this report, you agree to share your contact information with our wonderful sponsors who made this research possible.

Data for the 2023 Lighthouse Research & Advisory RPO Buyer Trends Study was gathered via online surveys from 519 talent acquisition and HR decision makers at US-based organizations across every industry with a minimum of 100 employees. This research was produced in partnership with the RPO Association and was underwritten by the following Gold members: Advanced RPO, ADP RPO, Aspirant RPO, Broadleaf Results, ClearEdge Marketing, Hueman RPO, and Orion Talent

The research committee included RPO leaders, talent acquisition executives, and consultants who contributed ideas and themes for the study.

As an independent analyst firm, Lighthouse Research and Advisory's research and reporting provides unbiased, neutral views of the HR technology marketplace. While this specific research was vendor-funded, it does not impact how Lightoughse shares the data with employers and practitioners.